Gold View

Commodity View:

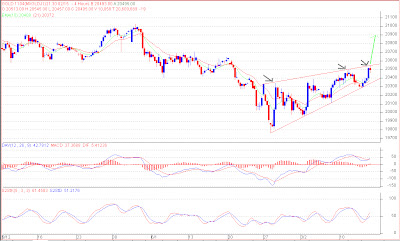

MCX Gold has been moving in a channel formation for more than 3-weeks. Prices touched the 2-months low of Rs.19766 and rose by more than 3.80% to above Rs.20550. Gold has tested the upper band of channel third time at Rs.20548. If the prices are able to close above Rs.20586, then the positive rally could continue till Rs.20800-21000. The positive breakout is possible as Moving Average Convergence Divergence (MACD) and stochastic are positive. The prices are even trading above short term Exponential Moving Average (EMA) of 10 and 21 days.

We suggest clients to buy MCX Gold on a close above Rs.20586 for the target of Rs.20800 / 20930 with the stop loss of Rs.20445 (Closing basis)

MCX Gold has been moving in a channel formation for more than 3-weeks. Prices touched the 2-months low of Rs.19766 and rose by more than 3.80% to above Rs.20550. Gold has tested the upper band of channel third time at Rs.20548. If the prices are able to close above Rs.20586, then the positive rally could continue till Rs.20800-21000. The positive breakout is possible as Moving Average Convergence Divergence (MACD) and stochastic are positive. The prices are even trading above short term Exponential Moving Average (EMA) of 10 and 21 days.

We suggest clients to buy MCX Gold on a close above Rs.20586 for the target of Rs.20800 / 20930 with the stop loss of Rs.20445 (Closing basis)

Comments

Post a Comment